Indian Ayurvedic Manufacturing Market Overview

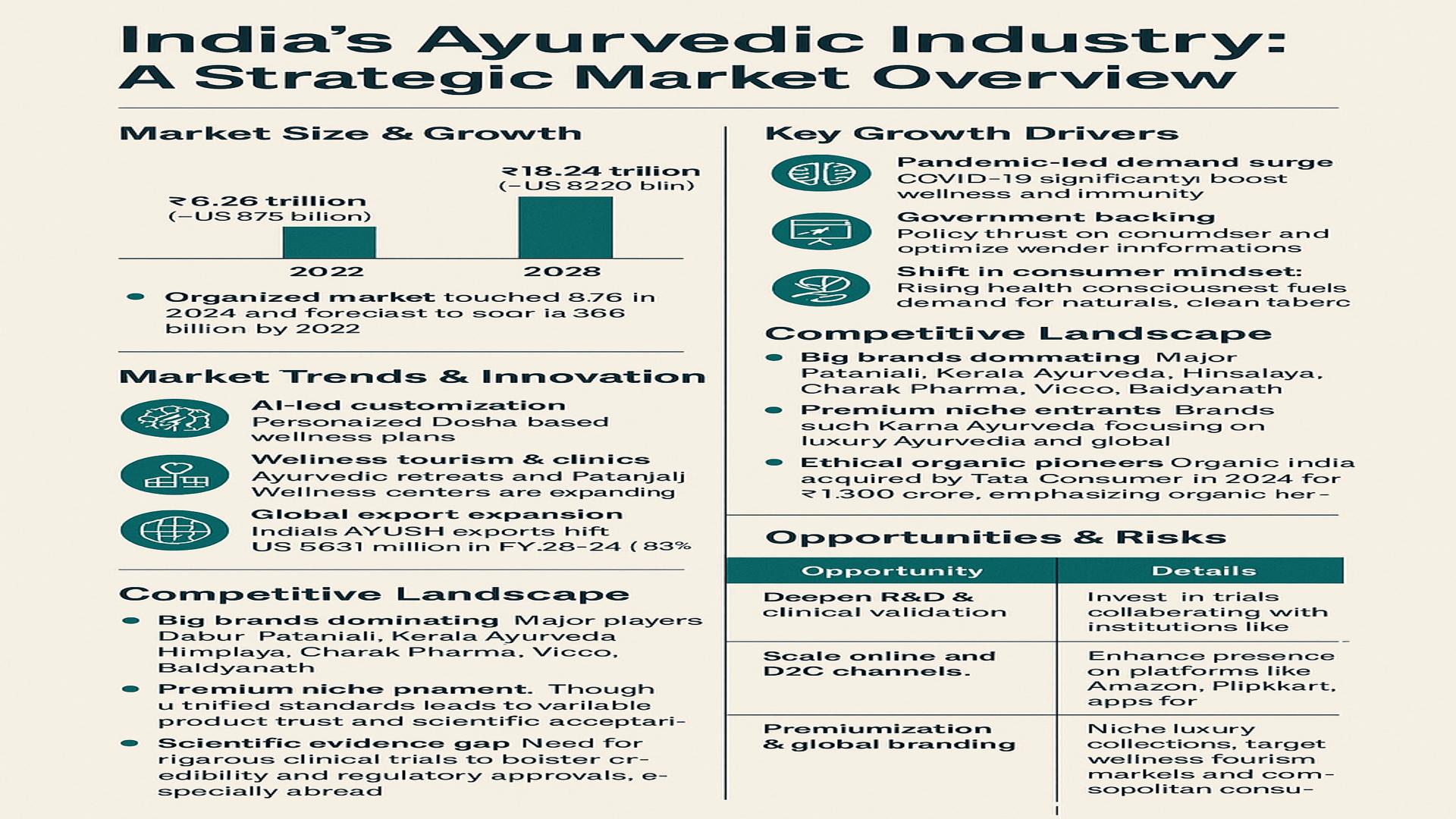

The Indian Ayurvedic Manufacturing Market Size was valued at USD 7.6 Billion in 2023. The Ayurvedic Manufacturing Market industry is projected to grow from USD 9.0 Billion in 2024 to USD 36.3 Billion by 2032, exhibiting a compound annual growth rate (CAGR) of 19.00% during the forecast period (2024 – 2032).Increasing consumer awareness and preference for natural and holistic healthcare and government initiatives promoting traditional medicine and Ayurveda are the main market drivers anticipated to propel the Ayurvedic Manufacturing Market in India.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Indian Ayurvedic Manufacturing Market Trends

- Minimal adverse effects of Ayurvedic drugs are driving market growth

One of the primary factors driving the growth of the Ayurvedic manufacturing market CAGR is the low number of adverse effects associated with its therapies. The demand for natural medicines that boost immunity has skyrocketed on the global market. The increased prevalence of obesity and chronic health concerns pushes consumers to consume foods and beverages that boost immunity. Ayurveda, the oldest therapeutic discipline, originated in India and has been practiced for over 5,000 years. It focuses on maintaining good health and preventing and treating illness through lifestyle choices such as massage, meditation, yoga, dietary changes, and herbal remedies. These five natural elements—space, air, fire, water, and earth—combine in the body to generate three energies: Vatta, Pitta, and Kapha. Ayurveda focuses on balancing the doshas that are required for optimal health. It can be used to improve flexibility, strength, and stamina, as well as to maintain good health and reduce stress. Ayurvedic medications are entirely made up of plant herbal extracts, as opposed to chemical-based allopathy treatments.

To remain competitive in the market, the sector’s key players tend to pursue a number of growth strategies, including capacity expansion, partnerships, mergers and acquisitions, product launches, geographic expansion, and product development. It is expected to have a positive impact on market growth. For example, in October 2022, Apollo Hospitals Enterprise began official talks to acquire a 60% stake in AyurVAID, a well-known classical Ayurvedic hospital chain. The acquisition would be funded by a mix of primary and secondary capital investments totaling INR 26 crore. In December 2019, Patanjali paid INR 4,350 crore (USD 610 million) for the insolvent Ruchi Soya Industries. Ruchi Soya, a mid-cap company, is listed on the NSE and BSE in India. Many developing countries’ healthcare systems rely significantly on Ayurvedic remedies. Most mild ailments are treated with herbal drugs and natural therapies. In impoverished countries, visits to trained physicians or pharmacists to fill prescriptions are uncommon and limited to critical ailments. Ayurvedic and herbal medicine used for medicinal purposes in developing countries consists of unprocessed herbs, plants, or plant parts that have been dried and utilized whole or chopped. Herbs are prepared as teas for internal use (and rarely as pills or capsules), as well as salves and poultices for external use, creating a commercial opportunity for Ayurveda. As a result, driving the Indian Ayurvedic manufacturing market revenue.

Indian Ayurvedic Manufacturing Market Segment Insights

Ayurvedic Manufacturing Product Type Insights

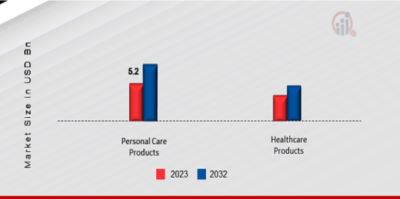

The Indian Ayurvedic Manufacturing Market segmentation, based on product type, includes Healthcare Products and Personal Care Products. The personal care products segment is driving the worldwide Ayurveda market, owing to growing awareness of personal care products, changes in consumption patterns and lifestyles, and higher spending power among women, all of which indicate the personal care industry’s growth because of the existence of established Ayurvedic manufacturing facilities.

Figure 1: Indian Ayurvedic Manufacturing Market, Product Type, 2023 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Ayurvedic Manufacturing Organized/Unorganized Insights

The Indian Ayurvedic Manufacturing Market segmentation, based on organized/unorganized, includes Organized and Unorganized. The organized segment has a large share. The organized section includes businesses that are properly licensed, follow regulatory rules, and have established manufacturing facilities and distribution networks. These companies frequently use standardized procedures, quality control measures, and good manufacturing practices.

Indian Ayurvedic Manufacturing Country Insights

India is likely to dominate the global Ayurvedic medicines industry. The worldwide Ayurvedic medication market would grow as local and global Ayurvedic medicine makers in India and other regions embrace technological developments. Furthermore, the Ayurvedic Manufacturing Market in India is rapidly expanding and is a key player in the worldwide Ayurvedic sector. Ayurveda, an ancient Indian medical system, has grown in popularity both domestically and internationally, resulting in increased demand for Ayurvedic products. The market is made up of both organized and unorganized firms. Established enterprises with appropriate licensing, quality control methods, and distribution networks dominate the organized segment. They invest in R&D, modern manufacturing facilities, and marketing activities to meet the growing demand for Ayurvedic products.

Indian Ayurvedic Manufacturing Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Ayurvedic Manufacturing Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Ayurvedic Manufacturing industry must offer cost-effective items.

Major players in the Ayurvedic Manufacturing Market are attempting to increase market demand by investing in research and development operations includes Dabur India Ltd., Patanjali Ayurved Limited, The Himalaya Drug Company, Vicco Laboratories, Charak Pharma Pvt. Ltd., Hamdard Laboratories, Forest Essentials, Emami Ltd., Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Kerala Ayurveda Ltd. and Amrutanjan Healthcare Limited.

Key Companies in the Ayurvedic Manufacturing Market include

- Dabur India Ltd.

- Patanjali Ayurved Limited

- The Himalaya Drug Company

- Vicco Laboratories

- Charak Pharma Pvt. Ltd.

- Hamdard Laboratories

- Forest Essentials

- Emami Ltd.

- Shree Baidyanath Ayurveda Bhawan Pvt. Ltd.

- Kerala Ayurveda Ltd.

- Amrutanjan Healthcare Limited

Indian Ayurvedic Manufacturing Industry Developments

April 2021: To promote AYUSH systems around the world, the Ministry of AYUSH has signed Country-to-Country MoUs with 18 countries for Traditional Medicine and Homeopathy cooperation, as well as MoUs for collaborative research/academic collaboration and the establishment of AYUSH Academic Chairs at international universities. Another method is to use the AYUSH Information Cells, which are located in about 28 countries and spread information about AYUSH systems.

June 2021: Marico, a global FMCG firm, said on July 14 that it had purchased a 60% stake in Apcos Naturals Private Limited for an undisclosed amount. Apcos Naturals Private Limited, formed in 2010 by CEO Arush Chopra and Brand Director Megha Sabhlok, launched Just Herbs, an ayurvedic cosmetic brand.

December 2019: Patanjali bought bankrupt Ruchi Soya Industries for Rs 4,350 crore (US$610 million). Ruchi Soya is currently a mid-cap company listed on the NSE and BSE in India. India is a big producer of soybean goods.

Indian Ayurvedic Manufacturing Market Segmentation

Ayurvedic Manufacturing Product Outlook

- Healthcare Products

- Personal Care Products

Ayurvedic Manufacturing Organized/Unorganized Outlook

- Organized

- Unorganized

| ReportAttribute/Metric | Details |

| Market Size 2023 | USD 7.6 Billion |

| Market Size 2024 | USD 9.0 Billion |

| Market Size 2032 | USD 36.3 Billion |

| Compound Annual Growth Rate (CAGR) | 19.00% (2024-2032) |

| Base Year | 2023 |

| Market Forecast Period | 2024-2032 |

| Historical Data | 2019-2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product, Organized/Unorganized, and Region |

| Countries Covered | India |

| Key Companies Profiled | Dabur India Ltd., Patanjali Ayurveda Limited, The Himalaya Drug Company, Vicco Laboratories, Charak Pharma Pvt. Ltd., Hamdard Laboratories, Forest Essentials, Emami Ltd., Shree Baidyanath Ayurveda Bhawan Pvt. Ltd., Kerala Ayurveda Ltd. and Amrutanjan Healthcare Limited |

| Key Market Opportunities | Expanding domestic and international market for Ayurvedic products. |

| Key Market Dynamics | Government support and initiatives promoting the use of traditional medicine |

🌿 Top 10 Ayurvedic Startup Brands in India

1. Kapiva Ayurveda

- Founded: 2015

- HQ: Mumbai

- USP: Modern ayurvedic wellness brand backed by Baidyanath. Offers juices, ghee, nutrition powders, and herbal supplements.

- Popular Products: Aloe Vera Juice, Amla Juice, Triphala Juice

2. The Ayurveda Co. (T.A.C)

- Founded: 2021

- HQ: Gurugram

- USP: Affordable luxury Ayurvedic skincare and wellness. Available in both offline and online retail.

- Popular Products: Kumkumadi Range, Face Serums, Hair Oils

3. Vedix

- Founded: 2018

- HQ: Hyderabad

- USP: Customized Ayurveda-based hair and skin care products using dosha-based quizzes.

- Popular Products: Personalized Hair Oils, Serums, Skin Creams

4. Ayouthveda

- Founded: 2020

- HQ: Delhi

- USP: Backed by AIMIL Pharmaceuticals. Targets younger audiences with premium Ayurveda-based personal care.

- Popular Products: Face Wash, Charcoal Face Mask, Skin Toner

5. Just Herbs

- Founded: 2010 (as a brand), scaled up as a D2C startup in recent years

- HQ: Chandigarh

- USP: Pure, organic Ayurvedic beauty products with transparency in ingredients.

- Popular Products: Lipsticks, Face Serums, Herbal Face Wash

6. Anveshan

- Founded: 2020

- HQ: Bengaluru

- USP: Farm-to-fork Ayurvedic food brand focusing on wood-pressed oils, ghee, honey.

- Popular Products: Cold Pressed Oils, A2 Ghee, Raw Honey

7. Amrutam

- Founded: 2006, rebranded as a startup in 2017

- HQ: Gwalior

- USP: Holistic Ayurvedic lifestyle brand—offering wellness products, content, and community.

- Popular Products: Kuntal Care Hair Spa, Face Clean-Up Gel

8. Bala Ayurveda

- Founded: 2021

- HQ: Pune

- USP: Focus on stress relief, women’s wellness, immunity through clinically backed formulations.

- Popular Products: Bala Shots, Immunity Boosters

9. Kapiva x Baidyanath

- Founded: Offshoot brand of Baidyanath Group

- USP: Combines 100-year legacy with startup agility. Focuses on young consumers.

10. Blue Nectar

- Founded: 2017

- HQ: Gurgaon

- USP: Ayurveda meets modern luxury. Premium packaging with certified natural ingredients.

- Popular Products: Hair Oils, Radiance Cream, Face Wash

- 🌿 Top Ayurvedic Startup Brands in India – Comparison Table

| Brand Name | Founded | HQ | Product Range | USP / Differentiator | Sales Channels | Distributorship / Partnership Potential |

| Kapiva | 2015 | Mumbai | Juices, Powders, Ghee, Supplements | Modern Ayurveda from Baidyanath | D2C, Amazon, Flipkart, Retail Stores | Good (Pan-India presence, expanding offline) |

| The Ayurveda Co. (T.A.C) | 2021 | Gurugram | Skincare, Haircare, Baby Care | Trendy Ayurveda, affordable luxury | Nykaa, Amazon, D2C, Retail chains | High (actively appointing distributors) |

| Vedix | 2018 | Hyderabad | Personalized Hair & Skin Care | Dosha-based custom products | D2C (Website), Amazon | Moderate (online-first brand) |

| Ayouthveda | 2020 | Delhi | Personal Care, Skincare, Haircare | Backed by AIMIL Pharmaceuticals | Retail, Pharmacies, Online | Strong (Good B2B model, open for dealers) |

| Just Herbs | 2010/17 | Chandigarh | Skincare, Lip Care, Haircare | Transparent Ayurvedic beauty | Website, Nykaa, Amazon | Good (Selective channel partnership) |

| Anveshan | 2020 | Bengaluru | Cold-pressed oils, Ghee, Honey | Farm-to-Fork purity focus | Online, Website, Amazon | Moderate (limited retail presence) |

| Amrutam | 2017 | Gwalior | Haircare, Skincare, Wellness Kits | Ayurveda + Wellness Content | Website, Amazon, Events | Moderate (Direct to consumer focused) |

| Bala Ayurveda | 2021 | Pune | Ayurvedic Shots, Immunity, Women’s Care | Stress & wellness oriented | Website, Health Stores | Growing (Open for regional tie-ups) |

| Blue Nectar | 2017 | Gurugram | Face Oils, Creams, Hair Oils | Ayurvedic luxury + natural claims | D2C, Nykaa, Amazon, Spas | High (Aggressively expanding offline) |

| Kapiva x Baidyanath | 2015 | Mumbai | Same as Kapiva | Backed by 100+ yr legacy brand | D2C, Modern Trade, Online | Very High (Wide distribution strategy) |

- 🚀 Brands Actively Seeking Distributors (High Potential)

| Brand | Regions Open For Expansion | Notes |

| T.A.C | PAN India | Accepting applications from beauty & Ayurveda channel partners |

| Ayouthveda | Tier 1 & Tier 2 Cities | Looking for pharma, beauty distributors |

| Kapiva | Tier 2, Tier 3 Cities | Expanding in modern trade and GT |

| Blue Nectar | Metro cities + North & West India | Retail store partnerships encouraged |

- 🤝 How to Approach for Distributorship

- Here’s how you can initiate partnership with these Ayurvedic startups:

| Step | What to Do |

| 1. Website Inquiry | Visit the official website and fill their “Distributors/Partners” form or visit Home – 1Click Distributors |

| 2. LinkedIn Connect | Connect with Founders/Business Heads (e.g., Co-founder of T.A.C) |

| 3. Email Pitch | Share your distribution credentials, region, and retail strength |

| 4. Showcase Infra | Mention warehouse, retail reach, marketing capabilities |

| 5. Ask for Sample + Rate List | Request product samples, trade margin, and TAT (turnaround time) |