Future of Distributor Appointment in India

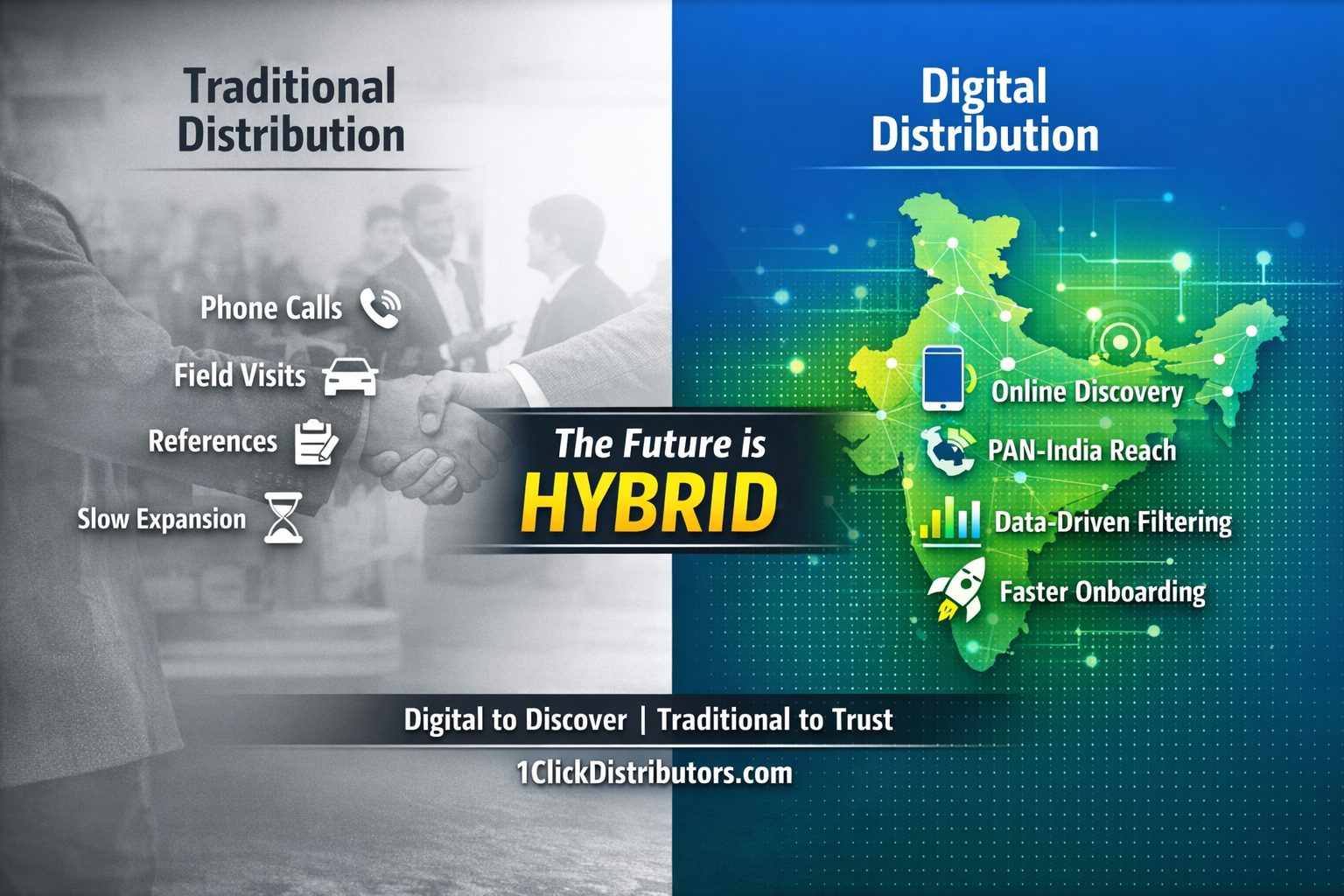

Digital vs Traditional

A comprehensive analysis of the future of distributor appointment in India, comparing Digital vs Traditional approaches, with practical takeaways for brands and business owners like you at 1ClickDistributors and others focused on expanding networks

📊 1. Market Context — Why This Matters

The Indian distribution ecosystem is evolving rapidly as consumption grows, retail formats diversify (kirana → modern trade → omni-channel), and digital tools empower smarter market coverage. Companies increasingly want speed, analytics, and efficiency in appointing distributors.

🔹 Traditional Distributor Appointment (Offline, Conventional)

Key Features

-

Personal networks / referrals

-

Territory managers traveling for face-to-face meetings

-

Manual data capture (calls, visits, Excel sheets)

-

Trust built through in-person interaction

Advantages

✔ Deep relationship building with local dealers

✔ Better understanding of ground realities in small towns

✔ Strong personal trust (important in India)

Challenges

❌ Slow and costly (travel, meetings, time)

❌ Hard to scale geographically

❌ Limited transparency and measurable performance tracking

📌 Best for: Products with very localized markets, high-trust environments, or industries where in-person sales are critical.

Future of Distributor Appointment in India

🔹 Digital Distributor Appointment (Data-Driven, Tech-Enabled)

Key Features

-

Online lead generation (SEO, marketplace listings, ads)

-

CRM + workflow automation

-

Digital onboarding & documentation

-

Performance dashboards

Advantages

✔ Faster reach across India

✔ Quantifiable metrics (lead source, conversion, response time)

✔ Lower acquisition cost per lead

✔ Allows remote onboarding & tracking

✔ Ideal for omnichannel strategies

Challenges

❌ Requires digital infrastructure & training

❌ Still building trust compared to long-term relationships

❌ Some Tier-II and Tier-III markets may not yet be fully receptive to purely digital outreach

📌 Best for: Brands targeting wide PAN-India expansion with measurable growth goals (e.g., natural products, tech goods, light consumer goods).

For example, your work with Naturified, Healthy Nestling, Swooger, etc., could benefit from digital funnels that find leads beyond immediate geographies.

🔄 2. Digital + Traditional = Hybrid is the Future

Most successful distributor programs will blend digital and offline, gaining the benefits of both:

🔸 Hybrid Model Benefits

-

Digital screening + offline validation

Identifying potential distributors online, then verifying with field sales -

Automated onboarding + personal training

Digital documentation with in-person product demos -

Data analytics + human relationships

Using insights while maintaining personal trust

Example Flow:

-

Digital Ad or SEO attracts distributor inquiries

-

CRM filters and qualifies leads

-

Regional sales team conducts field verification

-

Onboarding via digital system with e-contracts

-

Performance dashboard monitors results

📌 3. Trend Forecast (Next 3–5 Years)

| Aspect | Traditional | Digital / Tech-Driven |

|---|---|---|

| Lead Generation | Low scale | High scale, automated |

| Cost per Lead | High | Lower & measurable |

| Speed | Slow | Fast |

| Tracking & Analytics | Manual | Real-time |

| Market Coverage | Local | National / Tier-II & III |

| Training & Support | Face-to-face only | Digital + offline |

📍 Prediction: Digital-first strategies won’t replace traditional methods entirely in India — but they will become the default starting point for distributor appointment, especially for brands targeting scale and performance.

📍 What’s Driving Digital Adoption?

📈 1. Internet & Smartphone Penetration

Rising internet access in Tier-II and Tier-III towns means more distributors are discoverable and reachable online.

📊 2. Data & Analytics

Brands want to know which channels, which regions, and which types of distributors perform best.

⚙️ 3. Tools & Platforms

CRM, WhatsApp, e-signatures, automated workflows — make digital onboarding efficient.

💡 4. Younger Entrepreneur Demographic

Emerging distributor owners are tech-savvy, expecting digital interactions.

🚀 Practical Playbook for Brands

Step 1 — Map Your Ideal Distributor Profile

✔ Territory size

✔ Sales volume expectations

✔ Digital savviness

✔ Product category expertise

Step 2 — Build a Digital Funnel

✔ SEO for distributor pages

✔ Targeted social and search ads

✔ LinkedIn outreach & industry groups

✔ Distributor portals on website

Step 3 — Use Smart Qualification

✔ CRM + lead scoring

✔ Pre-qualification surveys

✔ Automated follow-ups (WhatsApp, emails)

Step 4 — Field Validation

✔ Local sales rep verification

✔ Mini onboarding events

Step 5 — Tracking & Feedback Loop

✔ KPIs: Response time, revenue per region, onboarding completion rate

✔ Feedback from distributors on onboarding quality

📌 Case Insight — What Works in India

FMCG & Daily-Use Products: Digital announcement + offline verification yields best results.

Technical & Industrial Products: Hybrid works extremely well because trust and training matter.

Lifestyle & Consumer Tech: Mostly digital onboarding and remote support works, with field demos as needed.

🎯 Takeaway

✔ Traditional still matters

✔ Digital is essential and growing fast

✔ Hybrid is the winning playbook

To build robust distributor networks in 2026 and beyond, brands must orchestrate digital lead generation, measurable workflows, and personal relationship building simultaneously.